Stock Trading Automated: How Kosh App & STM Do It Right

Table of Contents

Introduction: What You Will Achieve in Automated Stock Trading

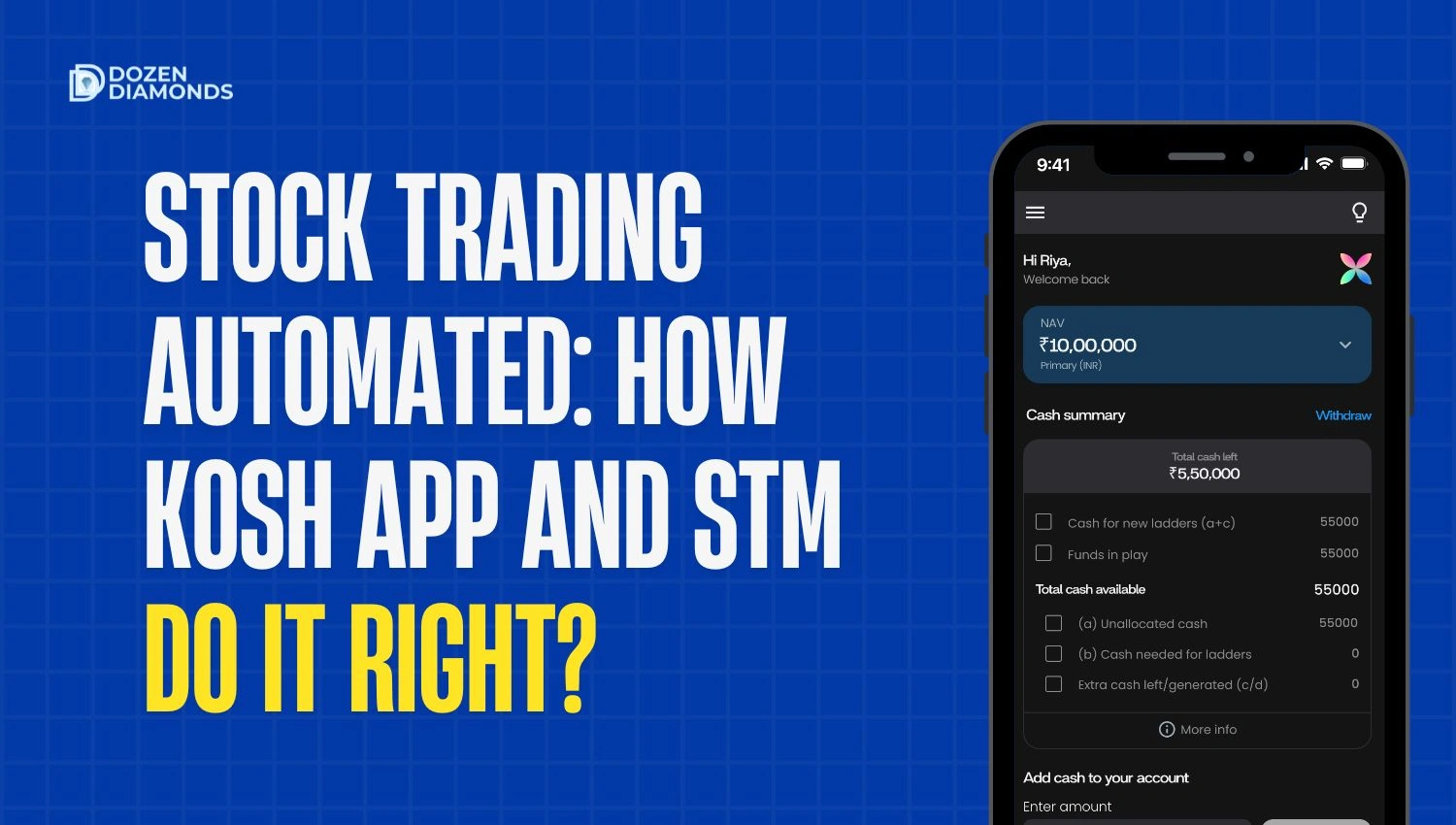

By reading this article, you will discover exactly how automated stock trading via the Kosh App using the Stressless Trading Method (STM) can let you earn consistent income without constant monitoring or risky predictions.

You’ll see proof from Kosh App users who have used STM to generate “Extra Cash” with every executed order—even during volatile markets—and retain clarity and control.

Here are three benefits you’ll get:

- Automation that aligns with your schedule — no live charts needed

- A transparent, logic-based system removing guesswork and emotion

- Built-in recovery so setbacks don’t derail your long-term growth

Capital Loss Recovery – Kosh App

- According to Kosh App’s description, it is one of the first platforms in equity stock markets using automated trading strategy STM; it emphasizes transparency, extra cash per trade, and “prediction-less” trading. Download

- In the Capital Loss Recovery content, the Kosh app is described as a white-box algo trading system with a built-in loss recovery mechanism—users can see why algorithm moves are made. Dozen Diamonds

Top Benefits You’ll Get

When you use automated stock trading through Kosh App + STM:

- More free time — let the algorithm execute trades instead of constant decision making

- Reduced emotional trading — fewer mistakes from fear, greed, or FOMO

- Predictable, consistent returns even during dips via recovery logic

Understanding Automated Stock Trading

What “Automated Stock Trading” Means

Automated stock trading (also known as algorithmic trading) refers to computer programs or algorithms that execute trades based on predefined rules or logic, without human intervention in every trade. You set the strategy, and the system executes. InvestopediaCommon Problems with Manual or Predictive Trading

- Over-reliance on predictions & forecasts, which often fail in volatile conditions

- Emotional reactions (selling in panic, buying on hype)

- Time demands: manual trading or constant monitoring is draining and often impractical for many professionals

The Stressless Trading Method (STM): Your Automation Backbone

Here’s how STM elevates automated stock trading through its unique features:

- Prediction-less Strategy: STM avoids forecasting; trades are logic/rule-based, reducing error from wrong predictions.

- Transparent Logic (“White-box”): You can understand the rules and triggers. No hidden code; full visibility.

- Loss Recovery Mechanism: When market dips happen, STM works to recover via built-in mechanisms so your drawdowns are systematically addressed.

How Kosh App Implements Automated Stock Trading with STM

- Streams trades automatically per the STM logic — you don’t need to set each trade manually.

- Generates Extra Cash with every executed trade order (both buy and sell) which you can withdraw separately.

- User dashboards show trade execution, rules triggered, loss recovery status, making the system transparent.

- Adjustable settings so risk tolerance and recovery speed can be set by the user.

Real Example: When Market is Volatile — How Kosh + STM Manages It

- A predictive/manual system may react late or wrongly.

- STM in Kosh App, however, would:

- 1. Trigger trades based on logic (not predictions) that are designed for volatility.

- 2. Use loss recovery features to buffer the dip.

- 3. Provide transparency so user sees exactly how app is acting, eliminating stress.

What Most Solutions Miss

Many articles on automated trading focus on strategy or performance but miss what people really want:

- No Prediction Needed: Many users hate trying to guess direction; STM avoids that.

- Full Transparency (“White-box”): Understanding trade logic, not just returns.

- Built-in Recovery / Extra Cash: Ensuring losses don’t compound and giving something tangible in the form of cash flow each trade.

These are the things people often ask

- “How do I know what rules are being used?”,

- “What recovers losses when I mess up?”,

- “Can I trust an algorithm I don’t understand?”

Step-by-Step Guide: Setting Up Automated Stock Trading with Kosh App

| No | Step | Action |

|---|---|---|

| 1 | Download & Register | Get Kosh App, set up your account. |

| 2 | Choose Your STM Strategy | Use the STM default or customize settings for risk and recovery speed. |

| 3 | Set Trade Rules | Confirm or adjust logic: for example, step size, order size exit criteria. |

| 4 | Observe, Don’t Micromanage | Let trades run; check dashboard for visible logic triggers and results. |

| 5 | Review Monthly | Assess performance vs recovery, adjust settings if needed. |

Summary Checklist

- Automation with rule-based STM logic

- Transparent, white-box view of trades & logic

- Loss-recovery built into system

- Extra Cash with each trade visible and withdrawable

- User control over risk & recovery speed

Next Step: Your Clear Call to Action

Ready to make your stock trading automated, stressless, and transparent?

Download the Kosh App today, activate the STM automation, and experience stock trading where your capital works while you live your life — no predictions, just proven logic.

Conclusion

Automated stock trading doesn’t need to be complex, overwhelming, or opaque. With stock trading automated through Kosh App and the Stressless Trading Method, you get clarity, consistency, and control.

Trade with confidence. Automate with trust. Grow with peace of mind.

FAQs: Risk Management in Algo Trading with Kosh App & STM

Unlike black-box platforms that hide their logic, Kosh App uses the Stressless Trading Method (STM) — a white-box algorithm. This means you see every rule, trigger, and recovery step, giving full transparency and trust.

No. Kosh App fully automates execution. You can review the dashboard periodically to see trade logic, recovery status, and Extra Cash earned. It’s designed for professionals who don’t have time to sit in front of live charts.

Yes. Since STM is a white-box algorithm, it provides complete audit trails and visible decision logic. This transparency makes it easier to comply with SEBI’s evolving algo trading guidelines, ensuring trust and regulatory ease.