Online Trading Platform Reimagined: Stressless Trading Method

Table of Contents

Introduction:

By reading this article, you’ll discover how to transform any online trading platform into a stressless automated cashflow machine using The Stressless Trading Method (STM).

Back tested performance charts and user testimonials show STM consistently delivers cashflow while eliminating stress and recovering losses.

Here’s what you’ll gain:

- Seamless automation that works within your existing trading platform

- Consistent cashflow even in sideways markets

- Stress-minimized execution with built-in risk and loss recovery

The world of online trading platforms—from Fidelity’s Active Trader Pro to Interactive Brokers’ TWS and Webull’s mobile-first interface—is rich with features but thin on emotional support and loss recovery. The Stressless Trading Method bridges that gap.

Why Today’s Online Trading Platforms Fall Short

Major finance sites like Forbes, NerdWallet, and Investopedia call out powerful platforms like Fidelity, Interactive Brokers, and Webull—each impressive in tools, pricing, and execution But they overlook critical pain points:

- Emotional burnout: users face fatigue from constant decision-making

- Fragmented trading routines: platforms focus on speed, not emotional workflow

- No built-in loss-recovery structure: traders must often self-manage drawdowns

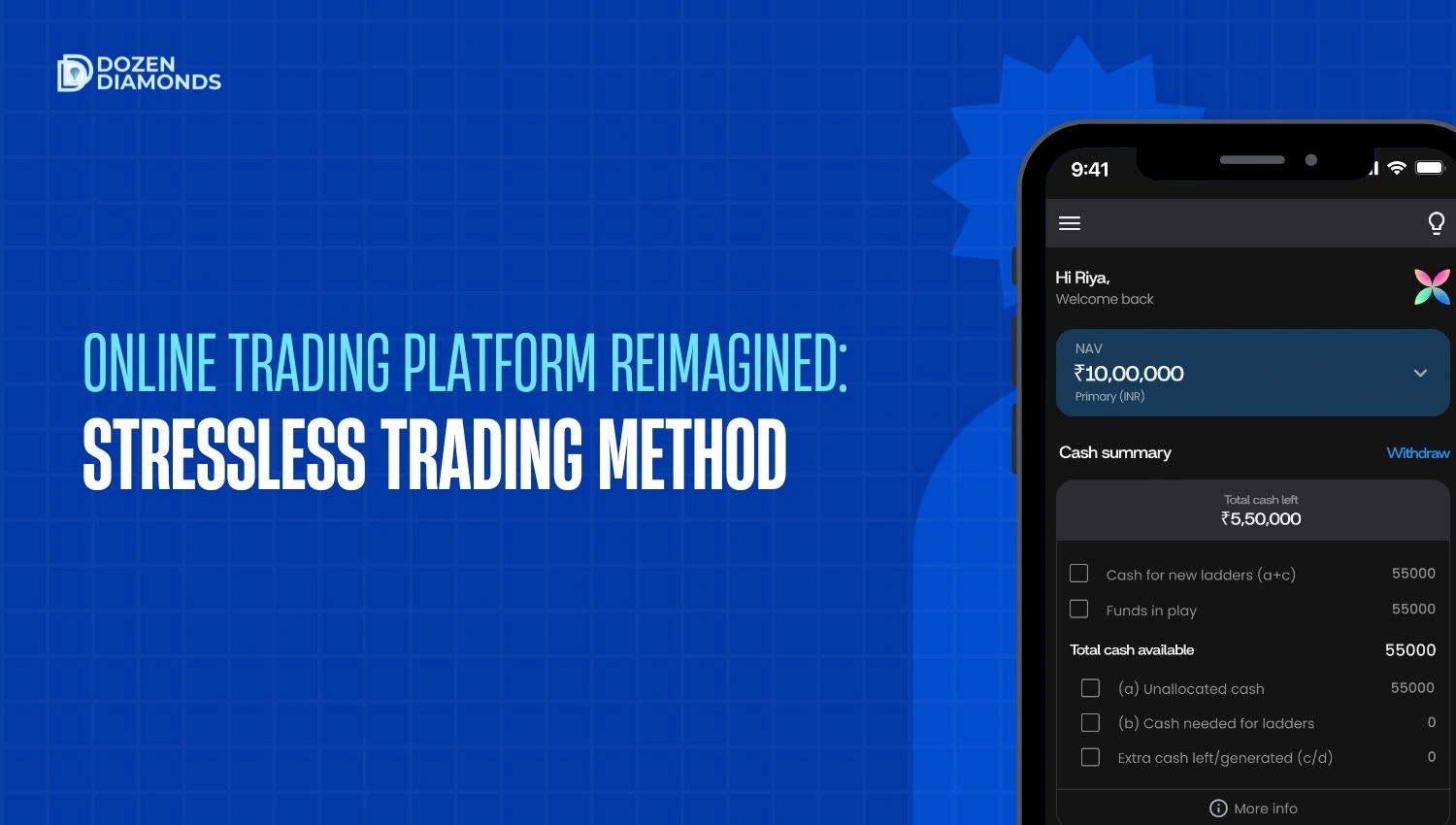

STM solves all of this—by augmenting the platform- Kosh App with automation, emotional buffers, and recovery cycles.

Introducing The Stressless Trading Method

STM is one of a kind online trading platform.

Its pillars are:

- Reactive automation: trades triggered based on real-time moves—not forecasts

- Loss-recovery loops: systems that rebuild capital incrementally with every executed trade

- Emotional resilience: Automated trading eliminates emotional decision

These pillars acting as solutions are missing in other online trading / algo trading platforms.

Psychology Meets Execution

Trading isn’t just about tools—it’s about mindset. High emotionality frequently derails execution. STM helps counteract this by:

- Eliminating impulse decisions through automation

- Encouraging trading discipline via automated trading

- Generating consistent cash flow with every executed order

As an effect, traders / investors experience stressless trading

Real Loss Recovery in Action

The Stressless Trading Method doesn’t shy from drawdowns. It tackles them through Extra Cash generated with every executed order while recovering losses.

Over time, Extra cash accumulated recovers the losses while eliminating stress.What Other Solutions Missed—Now Included

Typical solutions emphasize platform tools or risk principles—but STM covers what they’ve left out:

- True automation inside your platform—not just theory.

- Emotional support built into execution flow—not just “control your feelings.”

- Actual loss-recovery loops, not just stop-loss advice.

STM is where platform meets psychology.

Lifestyle & Emotional Payoff

- No more adrenaline-charged screen marathons

- Sleep better, knowing Kosh app executes the plan

- Spend time on what matters—family, creativity, balance

- Trade in a stressless way—not against your emotions

Next Step: Stressless Trading Awaits

The Stressless Trading Method redefines what an online trading platformcan do. It turns tools into therapeutic routines, drawdowns into recovery opportunities, and impulsivity into structure.

Next Step: Ready to transform your favorite online trading platform into a stressless trading engine?

Download the Kosh App powered by The Stressless Trading Method and start automated stressless trading today.

👉 Join the Stressless Wealth Community: https://chat.whatsapp.com/B79yCAm61fOH00Ip2DEWjd

❓ FAQs on Online Trading Platform

The Stressless Trading Method (STM) is a transparent, automation-driven trading framework that turns any online trading platform—like Fidelity, Interactive Brokers, or Webull—into a stressless, cashflow-generating system. It combines automated logic, emotional resilience, and built-in loss recovery to help traders achieve consistent performance without burnout or overtrading.

Yes. STM is designed to augment your current platform through the Kosh App, integrating seamlessly with existing tools. It automates trade execution, manages recovery loops, and ensures emotional control—without requiring you to switch platforms or learn complex coding.

Unlike stop-loss setups that lock in permanent losses, STM features loss-recovery loops that gradually rebuild capital through every executed trade. With each transaction, Extra Cash is generated, helping recover from drawdowns and maintain portfolio momentum—making trading both sustainable and stressless.

STM replaces emotional reactions with reactive automation and rule-based execution. This removes impulsive buying and panic selling, helping traders avoid fatigue and burnout. With STM active, you no longer chase market noise—your strategy executes calmly and consistently, even during volatile sessions.

Most algo systems are black-box models—they hide how trades are made. STM, by contrast, is a white-box method: every action is explainable and transparent. It goes beyond technical automation by integrating emotional discipline, capital recovery, and time-efficiency, creating a holistic stressless trading experience unavailable in other platforms.