Does Your Trading Strategy Help You Recover Losses?- Kosh App for Stocktraders

Table of Contents

Introduction

You’re about to learn how to make your trading strategy strong enough to recover from serious losses and stay resilient through market volatility (Kosh app for stocktraders).

This method has already helped many traders regain control during downturns—thanks to strategies like Stressless Trading Method and tools like the Kosh app for stocktraders.

Here’s what you’ll gain:

- An understanding of how loss recovery mechanisms really work

- A proven framework for consistent cash flow in any market

- A checklist to evaluate if your current strategy protects your capital

Most blog articles on trading talk about profits. But seasoned traders know that the real edge is how you recover after a 10–20% portfolio loss. Let’s dive deeper into how to integrate recovery into your trading.

Key Questions for Traders

Before we jump into solutions, consider these questions:

- Can your strategy recover efficiently from a 10–20% portfolio loss?

- Does it have built-in risk controls?

- Can it adapt to changing market conditions?

These are non-negotiables. any sustainable strategy must account for recovery and capital protection—not just gains.

Common Loss Recovery Tools in Algo Platforms

Automated trading platforms often include the following tools:

- Stop Loss & Trailing Stops: Good for immediate risk control but may lock in losses.

- Grid Trading: Works well in volatile sideways markets but risks overexposure.

- Martingale Strategy: Risky doubling-down method—not advised for most traders.

Yet, these tools alone don’t fully address emotional fatigue or capital depletion.

What’s missing is a structured recovery mechanism that generates positive cash flow—even during loss periods. That’s where STM and the Kosh app for stocktraders come in.The STM Method: A Smarter Way to Recover

STM (Stressless Trading Method) by Dozen Diamonds is a model focused on resilience, not just returns.

Here’s how STM helps recover losses:

- The “Extra Cash” Concept: Your cash balance keeps growing independent of portfolio value.

- No Directional Bias: Whether the market goes up or down, STM continues to generate cash.

- Cash-Flow Based Evaluation: It replaces the emotional pressure of watching red/green equity swings with a more stable cash generation metric.

- Reduced Exposure: You don’t need to go “all in.” STM inherently limits overexposure by only using capital strategically.

What Other Traders Are Missing

A review of top-ranking articles on this topic reveals:

- They focus heavily on theory, not actionable strategies.

- They lack real-life systems that integrate into trading platforms.

- They don’t offer a way to measure or monitor recovery progress.

What traders need:

- A tool that helps them track real-time loss recovery

- A system that works in sideways or unpredictable markets

- A way to stay psychologically calm during drawdowns

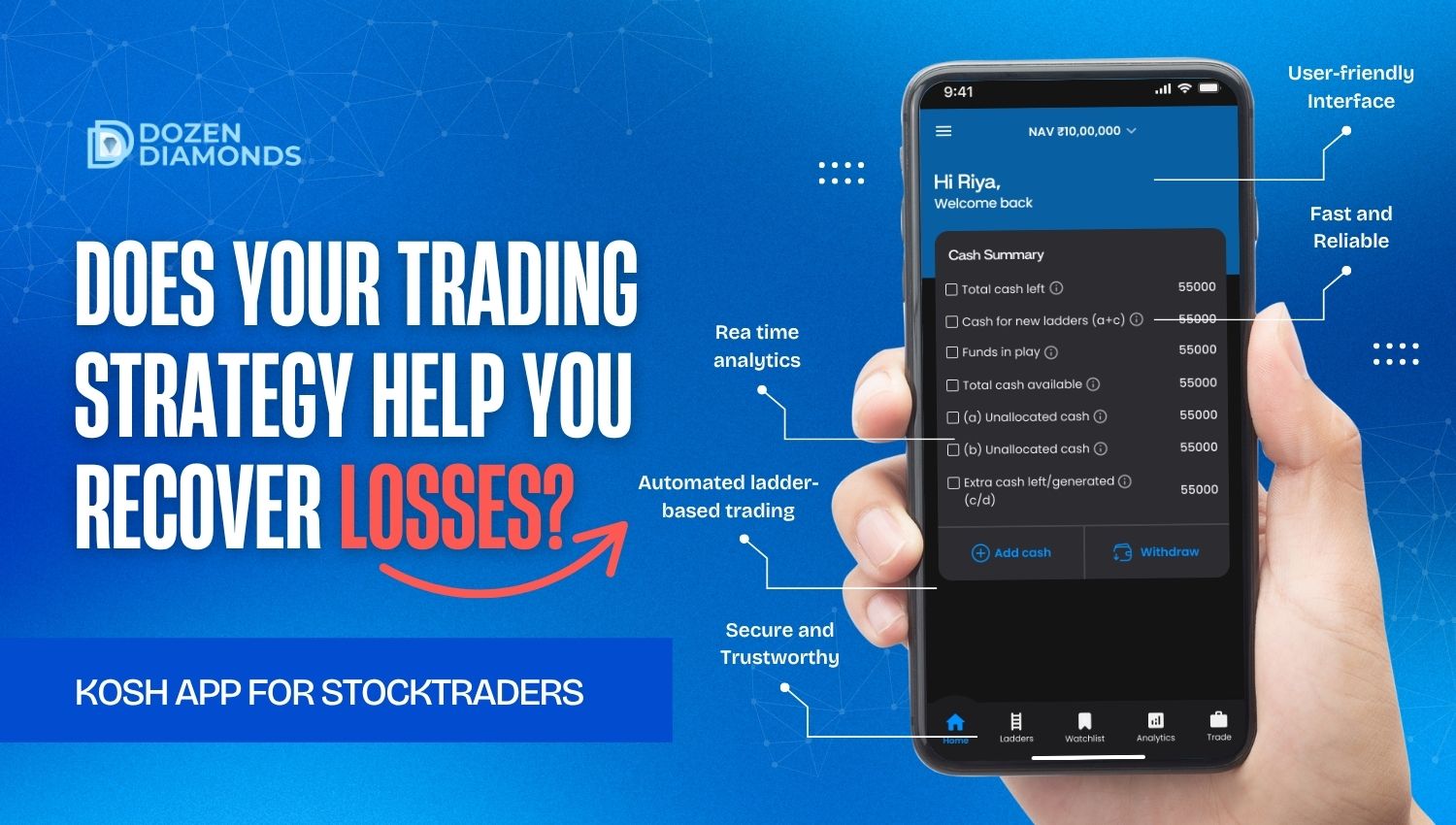

Filling the Gap: Why STM + Kosh App for Stocktraders Work

When you combine the STM framework with a robust algo platform like the Kosh app for stocktraders, the recovery process becomes seamless.

Why Kosh?

- Built-In Strategy Sync: You can integrate STM into your Kosh app setup, automating key principles like order execution and reserve capital usage.

- Recovery Visuals: The app provides analytics showing extra cash generation and recovery (Ladder’s value) curve.

- Risk Controls: Use Kosh to set capital exposure limits and manage cash based on STM metrics.

This makes the Kosh app for stocktraders more than just an execution tool—it becomes your trading control center.

Real-World Application: How Loss Recovery Plays Out

Imagine you’ve taken a 15% hit on a volatile stock position. Traditional logic says “cut your loss,” but STM takes a smarter route:

- Your reserve capital kicks in, executing fixed volume trades as the stock price fluctuates.

- Each trade generates “extra cash,” filling your recovery bucket.

- Instead of panicking, you watch your Kosh app show you daily progress in recovery.

- Emotional fatigue reduces as you see gains, even if the stock hasn’t fully rebounded.

A real-world case: Trader A used STM via the Kosh app for stocktraders on a sideways stock. After a 12% loss, STM recovered 9% in 17 trading sessions—without changing the stock or taking bigger risks.

Call to Action: Your Next Step

If your current strategy lacks a built-in recovery mechanism, you’re leaving yourself vulnerable in unpredictable markets. It’s time to upgrade.

👉 Explore STM by Dozen Diamonds inside the Kosh app for stocktraders.

Give your trading strategy a stressless, cash-flow-focused recovery system.

How does your strategy handle loss recovery? Share your experience in the comments.

❓ FAQs on Kosh app for stocktraders

STM focuses on generating Extra Cash through every executed trade, regardless of market direction. This creates continuous cashflow that helps rebuild your portfolio without relying on price rebounds or risky averaging-down.

Stop-losses lock in losses, grid systems can cause overexposure, and Martingale methods are too risky. These tools manage risk but don’t actively rebuild capital. STM fills this gap by creating structured, cash-flow-driven recovery during both dips and sideways markets.

Absolutely. STM reduces emotional fatigue by removing guesswork and replacing equity-focused thinking with cashflow-based evaluation. The Kosh App further supports this by showing steady recovery metrics, helping traders stay calm and consistent during drawdowns.