Is Trend Really Your Friend? Discover the Truth

Table of Contents (Is Trend Really Your Friend)

Introduction (Is Trend Really Your Friend)

By reading this article, you’ll discover why relying solely on trend-following strategies can be misleading and how a more nuanced approach can lead to consistent trading success. (Is Trend Really Your Friend)

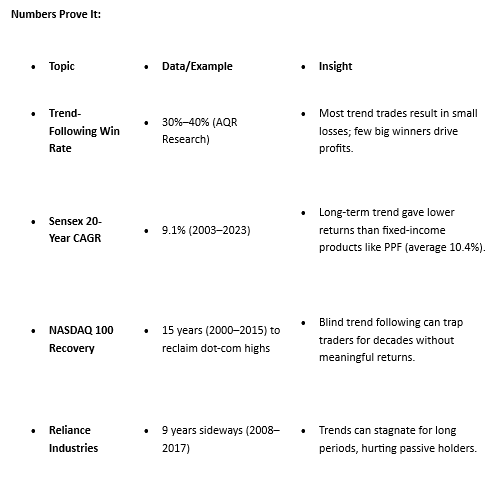

Research from AQR Capital Management indicates that trend-following strategies have a historical win rate between 30% to 40%, challenging the common belief of their high success rates.

Key Takeaways:

- Understand the limitations of trend-following strategies.

- Learn the importance of active trade management.

- Discover a method that leverages market volatility for consistent returns.

The Illusion of Certainty in Trend Trading

The adage “The trend is your friend” suggests that identifying and following market trends is a surefire path to profits. However, this belief can create a false sense of security.

According to AQR Capital Management, trend-following strategies have a win rate between 30% to 40%, not the 70%-80% success rate many traders assume. This means that most trend trades result in small losses or break-evens, with profits relying on a few significant wins.

Blindly following trends without considering market volatility and other factors is akin to sailing without checking the weather—calm seas can quickly turn stormy.

The Misconception: Buying and Holding Equals Trading

A common misunderstanding among traders is equating buying at a trend signal and holding for an extended period with active trading. In reality, this approach aligns more with passive investing.

Effective trading involves:

- ✅ Adjusting positions during market pullbacks.

- ✅ Scaling in or out based on market conditions.

- ✅ Actively managing risk in response to volatility.

It’s not just about the entry point; what you do between entry and exit defines trading success.

So much for “just buy and hold the trend” being a superior method.

- ✅ Trend can be a useful signal, but it is not a guarantee.

- ✅ Active trading decisions between entry and exit are what define real success in markets.

Introducing Dozen Diamonds: Turning Volatility into Opportunity

Recognizing the limitations of trend-following strategies, Dozen Diamonds offers an alternative approach that focuses on understanding and navigating market volatility.

Instead of solely relying on trend signals, our method helps traders capitalize on volatility — the true engine of trading.

The Stressless Trading Method Explained

Our Stressless Trading Method encompasses:

- ✅ Active Management: Constantly adapting positions based on real-time price behavior and volatility shifts.

- ✅ Quantified Decision-Making: Utilizing data-driven rules to determine optimal entry and exit points.

- ✅ Capital Efficiency: Allocating a portion of funds at entry while preserving the rest for future opportunities.

- ✅ Stressless Approach: Designed to function effectively in both rising and falling markets, reducing psychological stress.

This method transforms market fluctuations into opportunities rather than threats.

Conclusion

While trends can offer valuable insights, they are not guarantees of success. Relying solely on trend-following strategies can lead to inconsistent results. By adopting a comprehensive approach that includes active management and a focus on volatility, traders can achieve more consistent and stress-free outcomes.

Next Steps

Ready to move beyond traditional trend-following strategies? Join our exclusive webinar to learn how the Stressless Trading Method can enhance your trading performance.

👉 Reserve Your Spot Now

❓ FAQs on Is Trend Really Your Friend

A trend is no longer your friend when it shows weakness—like lower highs, support breaks, decreasing volume, or bearish candlestick patterns.

Yes. News, global events, institutional selling, or overextended prices can cause sudden reversals that trap retail traders.