The Grand Finale : The Stressless Trading Method vs Mutual Funds Which is better for retail investors?

Some say Mutual Funds will always dominate because professional management and diversification feel safer.

Others argue the Stressless Trading Method (STM) is the future—rule-based, transparent, and designed for controlled recovery rather than blind hope.

And now—we’re stepping into one of the most anticipated clashes of this debate competition.

🔥 The Grand Finale is coming 27th January 2026 at 7:00 PM a high-stakes showdown between the Instructor Team vs Product Development Team, with both teams battling to win the debate.

👉 Join the Stressless Wealth Community

✨ Highlights from Previous Rounds:

1️⃣3️⃣ White-box vs Black-box Algorithms: Which Will Survive Widespread Market Adoption?

The high-stakes debate, “White-box vs Black-box Algorithms: Which Will Survive Widespread Market Adoption?”, sparked deep thinking and sharp arguments within the Dozen Diamonds community on 23rd December at 7 PM. The Instructor Team delivered a compelling case grounded in transparency, risk control, and real-market behaviour, ultimately winning the debate against the Customer Service Team. It wasn’t just a discussion on algorithms—it was a decisive showdown between explainability and opacity, reaffirming that in the long run, clarity and structure shape sustainable trading success.

1️⃣2️⃣ Will Banning Target-Price and Stop-Loss Tips Help or Hurt the Market?

The debate sparked intense discussion across the Dozen Diamonds community, with the Customer Service Team defeating the Marketing Team through sharper logic and clearer market insight.

1️⃣1️⃣ Will Reducing Brokerage Charges Hurt or Help the Brokers?

The high-stakes debate, “Will Reducing Brokerage Charges Hurt or Help the Brokers?” ignited powerful discussions within the Dozen Diamonds community on 9th December 2025.

The Product Development Team delivered a sharp, data-backed performance, outmanoeuvring the Instructor Team with clarity, conviction, and strategic insight into brokerage economics. And in this intense intellectual showdown, the Product Development Team emerged victorious, securing their place in the grand finale.

🔟 Ideas & Innovation vs Knowledge & Resume

9️⃣ Can the Manufacturing Sector in India Become Stronger?

On 18th November 2025 at 7:00 PM IST, the Product Development Team won the debate against the Marketing Team by taking a strong stand against the topic: Can the Manufacturing Sector in India Become Stronger?

Their victory underscored a critical message: India’s manufacturing rise needs deeper reform before true strength can emerge.

8️⃣ Is the Indian Economy Suffering Because of Its Fixation on Gold?

Kudos to both teams for a golden debate that truly sparkled!

7️⃣ Am I Working for My Country or Myself?

The debate “Am I Working for My Country or Myself?” on 4th November 2025 sparked powerful perspectives at Dozen Diamonds.

The Customer Service Team passionately stood for national purpose, while the Product Development Team argued for self-driven growth.

After a gripping exchange, the Customer Service Team triumphed over Product Development Team.

A thought-provoking win celebrating purpose, pride, and passion!

6️⃣ Optimism vs Pessimism — What Works?

The electrifying debate, “Optimism vs Pessimism — What Works?”, lit up the Dozen Diamonds community on 28th October 2025. In this high-intensity face-off, the Marketing Team (Deep Roy & Rutuja Kamble) clashed with the Instructor Team (Nishant Upadhyay & Rahul Singh) in what was dubbed “The Finals Before the Semifinals.”

Both sides delivered sharp reasoning, psychological insights, and real-market parallels — balancing logic with emotion, and research with experience.

The result? A perfect tie.

A fitting outcome for a debate where both optimism and pessimism proved essential forces in the stock market investment

5️⃣ Is following trends alway successful?

The debate “Is Following Trends Always Successful?”, held on 14th October 2025, sparked a dynamic exchange of logic, foresight, and strategy at Dozen Diamonds. The Product Development Team, led by Sumit Gautam and Sohel Yunus, challenged the comfort of conformity with powerful arguments on innovation and independent thinking — ultimately outsmarting the Sales Team. Their win highlighted a powerful truth: success doesn’t come from following every trend, but from knowing when to break away and create your own.

4️⃣ Is the stock market a casino?

The fiery debate “Is the Stock Market a Casino?”, held on 7th October 2025, saw sharp wit and deep market insights collide at Dozen Diamonds. The Marketing Team, represented by Ishika Pola and Vaibhavi Pai, powerfully dismantled myths equating the stock market to mere chance, arguing instead for knowledge, discipline, and data-driven investing. Their compelling reasoning and confident delivery earned them victory over the Customer Service Team, proving that understanding the market isn’t gambling — it’s strategy with purpose.

3️⃣ Can every small idea become a big idea?

The thought-provoking debate “Can Every Small Idea Become a Big Idea?” held on 30th September 2025, turned into a battle of innovation versus execution at Dozen Diamonds. The Instructor Team, represented by Abhinav Panchal and Nishant Upadhyay, captivated the audience with their sharp reasoning and real-world analogies, ultimately outshining the Product Development Team. Their victory highlighted one timeless truth — big ideas aren’t born overnight; they’re built on clarity, conviction, and the courage to think differently.

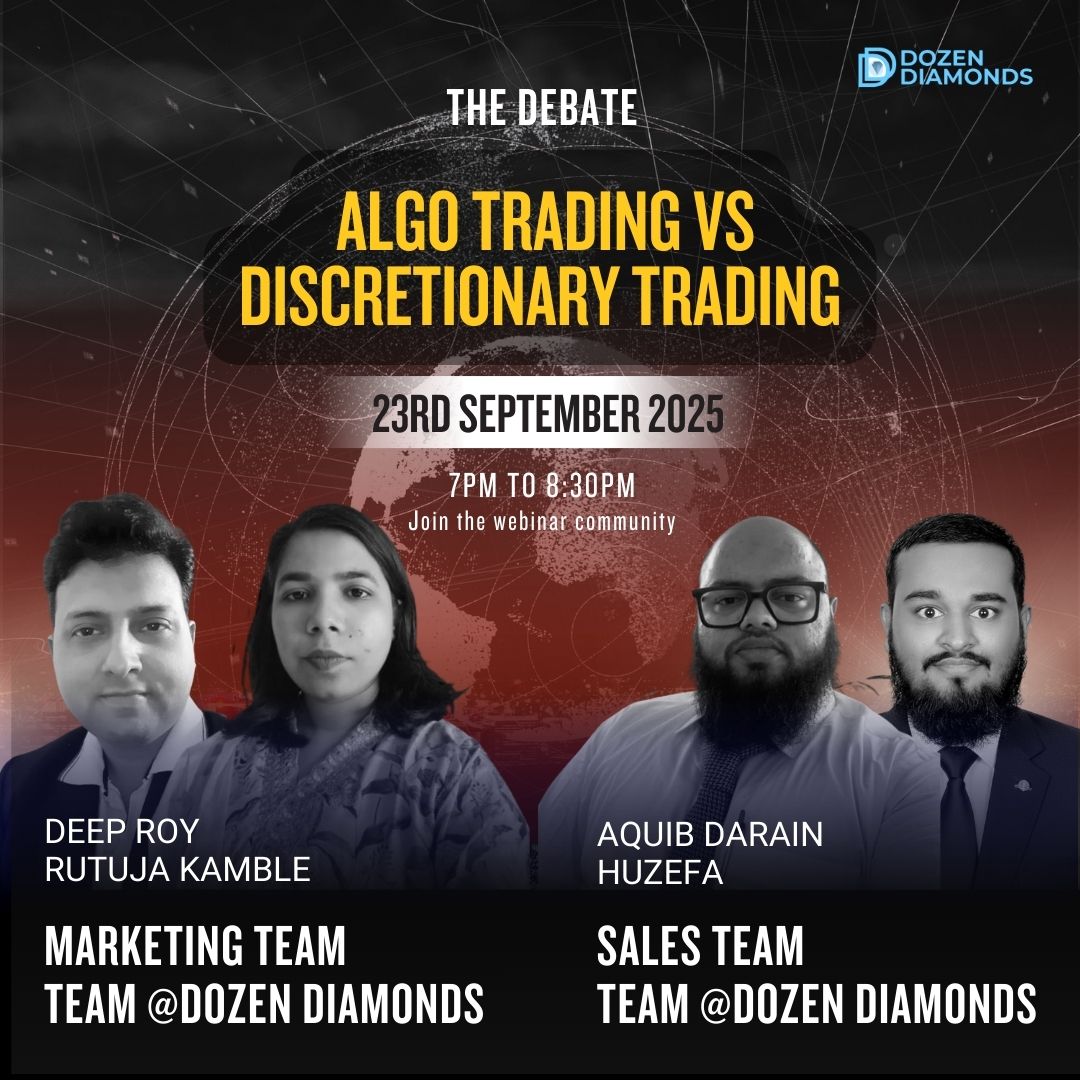

2️⃣ Algo trading vs Discretionary trading

The debate “Algo Trading vs Discretionary Trading” on 23rd September 2025 set the Dozen Diamonds stage ablaze with data-driven arguments and strategic insights. The Marketing Team, led by Deep Roy and Rutuja Kamble, impressed the audience with their analytical depth and mastery of automation logic — ultimately outclassing the Sales Team in both precision and persuasion. This round wasn’t just about trading styles; it was about the future of smart investing — and the Marketing Team proved they had their pulse on it.

1️⃣ Does Technical Analysis Really Work?

The high-stakes debate, “Does Technical Analysis Really Work?”, brought intellectual fireworks to the Dozen Diamonds community on 16th September 2025. The Instructor Team represented by Vinay Ghavghave and Rahul Singh, showcased sharp logic and real-market insights to outwit the Customer Service Team, delivering a masterclass in practical trading wisdom. It wasn’t just a debate — it was a clash of experience vs. perception, proving once again that skillful reasoning always wins in the world of trading.

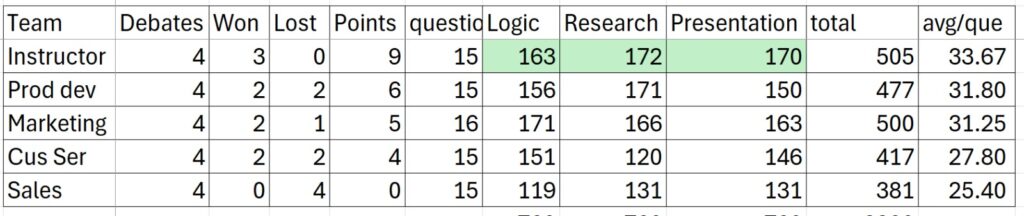

🏆 The Scoreboard Update

Join us to witness an evening of compelling arguments, sharp wit, and powerful insights that go beyond the debate floor.

👉 Join the Stressless Wealth Community