Algo Trading Strategy Loss Recovery That Actually Works

Table of Contents

Introduction:

If you’re relying on an algo trading strategy, you need to make sure it includes loss recovery mechanisms—or risk wiping out your portfolio after a major drawdown.

This post includes a real-life example from Dozen Diamonds’ STM platform that proves consistent cash flow can accelerate recovery.

You’ll learn:

- Why most strategies fail at handling a 10–20% drop

- How STM builds recovery into every transaction

- What your next step should be if your current system lacks risk control

What to Expect from This Article

Learn how a real-world algo trading strategy loss recovery system helps you bounce back from market shocks. See how Dozen Diamonds’ Stressless Trading Method (STM) uses a built-in risk management mechanism to create consistent “Extra Cash” and smooth out recovery.

Does Your Trading Strategy Enable Loss Recovery?

Many traders focus solely on profits—but ignore how they’ll bounce back after a drawdown. A true edge isn’t just about entries and exits—it’s about resilience. A good strategy requires a solid risk management system.

If your strategy doesn’t include one, it could be problematic during a market crash. There will always be the question: how will you recover your losses? So, let’s talk about it.

Key Questions for Traders

- Can your strategy recover efficiently from a 10–20% portfolio loss?

- Does it have built-in risk controls?

- Can it adapt to changing market conditions?

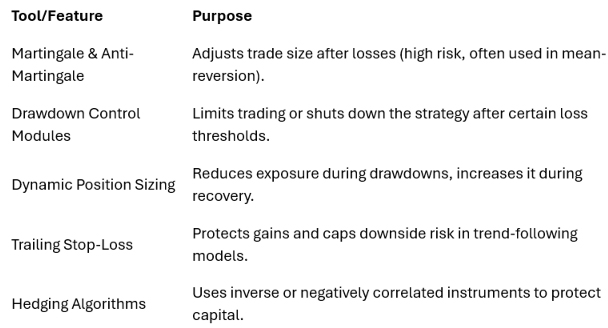

Common Loss Recovery Tools in Algo Platforms

STM by Dozen Diamonds: A Real-Life Example

This is where the Stressless Trading Method (STM) from Dozen Diamonds stands out.

- The “Extra Cash“ concept plays a key role in loss recovery and helps recover your investment over time.

- By keeping a portion of the capital in reserve, STM buys and sells at every price point movement.

- STM generates “Extra Cash” with every executed order. This cash flow is consistent and positive regardless of the stock’s price direction.

- STM introduces a performance metric other than profit to evaluate your portfolio, which reduces emotional strain and supports smoother recovery without overexposing capital.

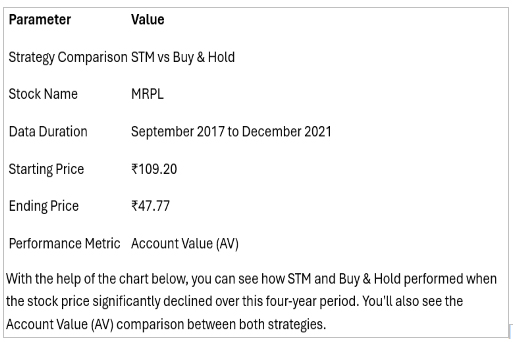

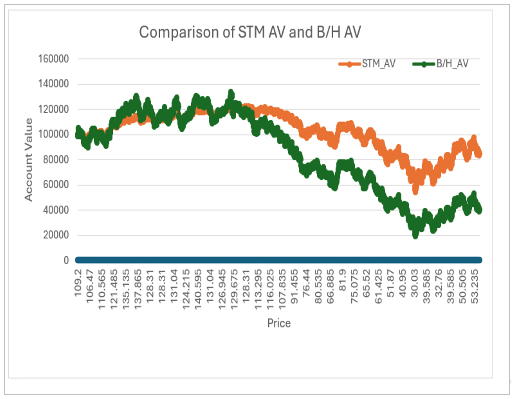

For a better understanding of how STM enables algo trading strategy loss recovery, let’s take a real-life example:

Final Thoughts

If you want to navigate any kind of market trend or scenario, your trading strategy must include a proper risk management system.

If it doesn’t, you should consider trying STM by Dozen Diamonds. It gives you an edge by generating consistent cash flow in any market scenario.

✅ Next Step

Try the STM simulator on the Kosh app and test your strategy’s ability to recover from drawdowns.

Let us know: How does your algo trading strategy handle loss recovery?

❓ FAQs on algo trading strategy loss recovery

STM generates Extra Cash with every executed order, regardless of price direction. This creates steady cashflow that helps rebuild your portfolio while keeping your capital exposure low. STM also uses reserve capital to re-enter markets strategically during dips.

Stop-losses prevent deeper losses but do nothing to recover capital already lost. STM focuses on cashflow-based recovery, ladder entries, and controlled exposure — enabling recovery even in sideways or declining markets.